The definition of insanity and Ky.’s pension crisis

Published 6:27 am Tuesday, October 17, 2017

They say that the definition of insanity is doing the same things over and over and expecting different results. Instead of reimagining our state’s failing pension system through a structural overhaul, some interest groups want little or no changes to the way our system has been operating. That is a recipe for failure considering our $64+ billion in unfunded pension liabilities and the exponential year after year growth of our debt. Recognizing that this system is unsustainable and unsustainable systems provide no peace of mind to retirees is crucial to having a reasonable discussion on the issue.

Two questions that public sector union employees should be asking of organized labor bosses are, “If the current defined benefit plans work so well, why are Kentucky’s plans in such dire straits?”, and “Will the state magically get the funding right?” The answer to both questions is obvious.

Taking the potential for future underfunding for new hires off the table is the first step toward a solution. As evidenced across the country, and especially here in the Bluegrass State, defined benefit plans encourage pernicious procrastination. Kentucky politicians have a history of making promises without providing the right funding and actuaries struggle to get the numbers right with a funding system pegged to payroll. Money isn’t placed into the funds as it should be.

A better model and one that will end this vicious cycle, is a move to defined contributions for new hires, much like the private sector embraced in the last 20+ years. These are the retirement plans of choice for Fortune 500 and small business employees, as well academics in higher education throughout the country (U of L and UK included).

It’s really quite simple: employees and employers contribute a certain amount into the retirement account with each paycheck. These funds are invested and grow into a pool of funds the employee can live off of in retirement. Employees have ownership over the account and thus the ability to manage the funds personally or hire professional managers or simply place in a target date fund. They can take it with them whether they go in or out of the public sector or move in or out of Kentucky. The beauty is the government makes its full contribution as the employee does his or her work.

This will keep Kentucky from accruing new liabilities. Kentucky can then focus on paying off obligations to retirees and current employees.

The alternative is to do nothing and to careen closer to insolvency. And we are very close to that cliff. Depending on the strength of the economy, in three to five years, the first system will run out of cash. THAT is the frightening scenario that should keep retirees up at night.

For the taxpayer, a continued unreformed system will mean increasingly painful cuts to education, healthcare, public safety, and transportation. This phenomenon is what economists call ‘crowding out’. It’s already happening. Just look at the shrinking levels of funds that go to university budgets. Sacred K-12 programs will be the next casualty of the pension tsunami and our children will feel the brunt.

It’s time to be honest with ourselves that changes are needed for our new hires. There is no magic wand, but there can be more choice and discipline. We can stop digging a bigger hole.

They say that the definition of insanity is doing the same things over and over and expecting different results. We have 64 billion reasons to change that now.

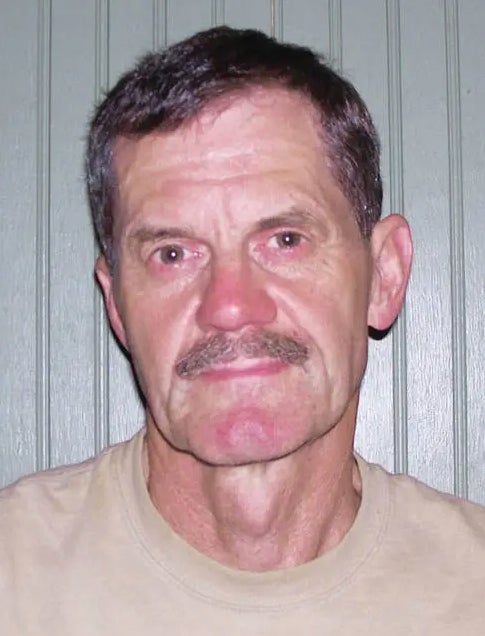

Jim Hill lives in Louisville and is a CPA and Attorney